Dear Reader,

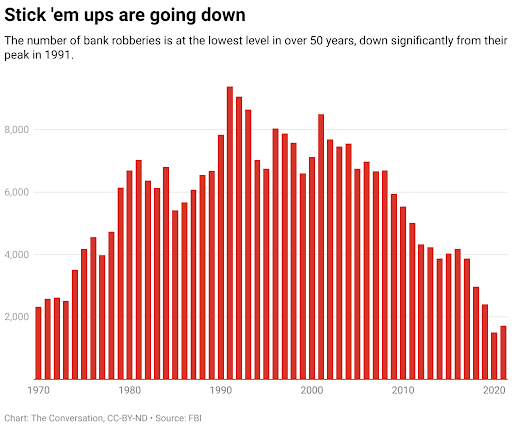

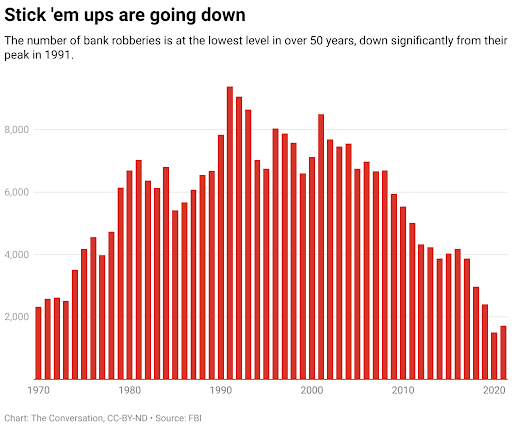

The FBI notes that bank robberies have hit their lowest levels in 50 years.

Gone are the days of Bonnie and Clyde, Butch Cassidy, and other bank bandits.

It’s hardly surprising given the trends in finance.

In fact, the lack of bank robberies tells us exactly what to make of the industry in the years ahead. More important, we know that trading cheap banks is a great way to make money in an uncertain market.

Let’s look at three bank stocks that are so cheap… you’re almost robbing them.

Banking Bandits Go Bye Bye

We might watch Hollywood movies and find ourselves entranced by the pulse-pounding scenes of bank stickups. Think The Dark Knight, Point Break, The Town, Heat, Dog Day Afternoon, and the incredibly underrated Inside Man.

But bank robberies today don’t typically involve teams of robbers brandishing weapons.

In fact, about 85% of bank robberies happen, rather quietly, at the bank teller’s window.

Someone walks up (usually without ever showing a weapon) and demands cash. It’s very rare that a bank is robbed after hours. And the average thief ends up walking with about $4,200. That payday is down from an average of $5,200 (or $38,000 in today’s dollars) from the 1960s.

That seems like a lot of money… until you realize that the average credit card thief can effectively steal $60,000 in less time than a physical bank robbery.

Today, banks are carrying less cash than ever, as we move toward a more cashless society. The bulk of cash withdrawn is done so through ATMs. So… banks have less cash at their windows.

If you make a larger withdrawal today, tellers typically have to walk back into another room to authorize it. And it can be a rather lengthy process (especially if you pull more than $10,000 in cash).

Now, here’s an even crazier statistic: The reward for most robbers doesn’t match the risk. Anyone who injures a person while robbing a bank will get an additional 25 years added to their sentence, according to The Conversation.

But the average person who stole $60,000 in credit card fraud received… an average of two years prison time, according to a 2016 report from The United States Sentencing Commission.

Incentives… and disincentives… matter. The number of bank robberies has plunged over the last 30 years. In 1991, bank robberies peaked at 9,388 events. By 2021, the figure fell to 1,724.

The other thing driving this reduction? Banking consolidation and the number of branches open around the United States. The number of banking branches from 2009 to 2020 declined by 15.2%.

I fully expect that trend to continue in the years ahead.

Banking Consolidation Disrupt the Bandits

The U.S. banking system has experienced dramatic consolidation over the last 35 years. In 1987, there were more than 15,000 U.S. banks. Today, there are roughly 4,500.

The banks didn’t go out of business. They weren’t robbed of all their capital.

The trend is consolidation – bigger banks buying smaller banks. And it’s been a big money maker for investors who buy cheap banks and ride the consolidation wave.

Want to know how to “rob” banks? Buy the ones trading for less than a Tangible Book Value of 1. These banks are trading for less than the sum of their parts.

Think of it this way…

A bank has $10 million in its vaults. But for some reason, the stock is trading for 60 cents on the dollar.

This is way more common than it seems. In fact, 46 banks trade on U.S. exchanges for less than their tangible book value.

All you do is buy a basket of them… and wait.

Three names trading for 65 cents on the dollar or less:

- OptimumBank Holdings (OPHC – 0.56x)

- Republic First Bancorp (FRBK – 0.65x)

- First Internet Bancorp (INBK – 0.65x).

Buy and hold these names. It almost feels like you’re stealing.

To your wealth,

Garrett Baldwin

P.S. Please let me know if you have any feedback, questions about today’s issue or anything else. Just email us at hubfeedback@wealthpress.com.

*This is for informational and educational purposes only. There is an inherent risk in trading, so trade at your own risk.

Market Momentum is Green

Momentum remains positive, but the market showed a surprising top pattern last week after the S&P 500 pushed against its 200-day moving average. Markets appear to be waiting for Microsoft’s earnings, an update on GDP, and Friday’s PCE measurement. Meanwhile, our Tactical Wealth Investor continues to show the best combination of value and income in this tricky trading environment. Our most recent pick has increased more than 10% since January 1. And we have a brand-new pick emerging during the first week of February.